The cost of living in the UK is more expensive than in 80% of countries in the world with single person estimated monthly costs at £2,201.

In these conditions, claiming Universal Credit to help with living costs is common with more than 5.8 million people claiming UC in England, Scotland, and Wales.

We will tell you:

- How much Universal Credit allowance you can get

- Tips to cut down your essential costs to £250

- Additional benefits of Universal Credit you can avail

Universal Credit Allowance – What you can claim

If you are out of work or low-income (lower than UK’s 60% median income), you can qualify for a standard allowance:

- The single claimant under 25: £265.31 per month

- Single claimant 25 or over: £334.91 per month

- Joint claimants both under 25: £416.45 per month

- Joint claimants either aged 25 or over: £525.72 per month

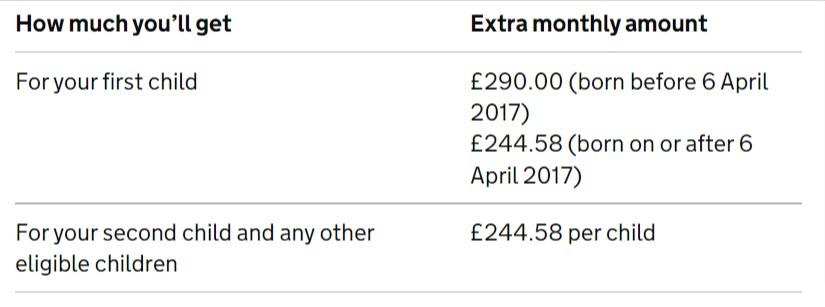

- Each child: £250 – £290.

Let’s take a household for instance with two adults and two children. Universal credit will give you an allowance of around £1000 – £1500. The average disposable income in the UK is £31,400. With Universal Credit, you are nowhere close to this number. If you have a couple outside Greater London, you have a £20,000 a year cap, and inside Greater London, you have a £23,000 a year cap.

The solution is learning to live on the bare minimum in this time of crisis.

In this article, we will help give you tips on how to cover your essential costs like food and water for under £250 a month. It does not include rent which can be anywhere from £800-£1200.

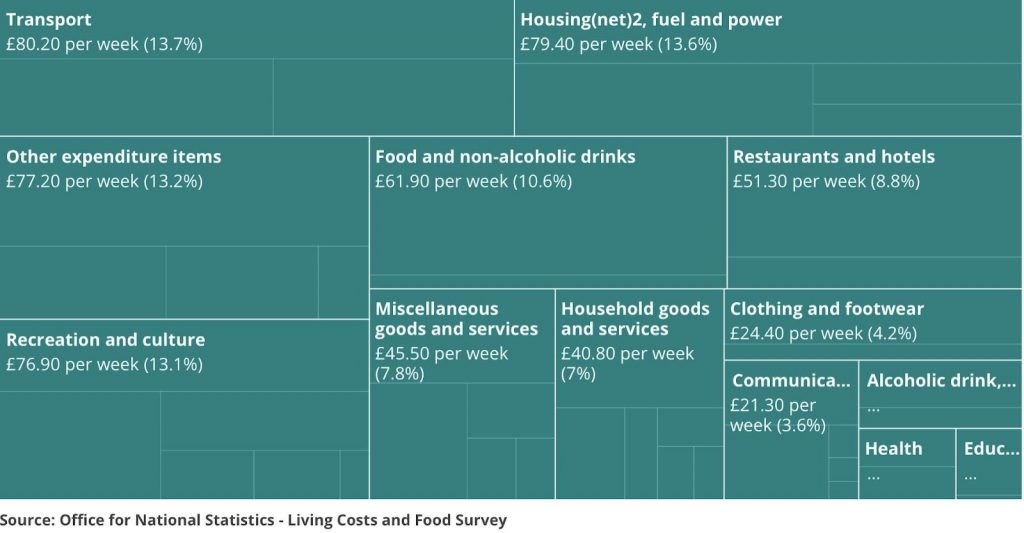

This is how a UK household spends £585.60 per week. Let’s focus on where we can cut down.

5 Tips on reducing Spending to keep Costs under £250

1. Cut down Food Costs

Households are spending £62/week on food and 51/week on restaurants. Eating in restaurants is not an option on your budget.

Households are spending £62/week on food and 51/week on restaurants. Eating in restaurants is not an option on your budget.

One person can actually survive on £15-20/week when it comes to balanced food. This comes to £60-£80 a month.

Cut down on restaurant costs by packing yourself lunch if you must go to work. You can also do weekly budget meal prep, cook in large batches, and freeze the leftovers.

Prepare more raw food dishes to save on energy for cooking meals.

Tip: View this video to learn how you can prepare a £6/week meal prep plan. You can find other videos and tips from chefs like Jamie Oliver as well that will help you prepare cheap nutritious snacks and meals.

2. Find cheap Clothing

One household spends £25/week on clothing. Locate good charity shops like Oxfam Shop and local thrift stores around you.

You can find T-shirts for as cheap as £3. Alternatively, you can use secondhand shops or apps where you can buy used clothes in good condition for often half the price.

3. Reduce your Household Bills

The major household bills you need to pay are electricity, heat, and water, about £80/per week for an average household.

The major household bills you need to pay are electricity, heat, and water, about £80/per week for an average household.

Price comparison websites are your best friend. Find the cheapest resources by comparing prices.

A four-bed house with an occupancy of four people can actually manage with £120-150 a month. This means £30-40/per person. And if you can use more sustainable energy sources like solar, you can make additional savings.

4. Use more affordable Transport

Abandon your dreams of a car. There is no set figure of what you can cut your transport costs too because it depends on where you can commute. A household spends £80/week on commuting. Which means one person spends £80/month.

Abandon your dreams of a car. There is no set figure of what you can cut your transport costs too because it depends on where you can commute. A household spends £80/week on commuting. Which means one person spends £80/month.

Here is how you can save money on transport:

- Railcards are £30 per year, and they could save you up to a third of the cost of your rail ticket.

- Find carpool services online.

- Use services like Trainsplit that split the tickets for you.

- Bikes are your best friend. Use them for short-distance commutes.

5. Learn from Students

If we take transport to be £60/month, clothing £40/month, food £80/month, and bills £40/month, we are at £190/month.

This gives you room to plan for entertainment. There is no doubt that you have a social life and need to go out with other people even when you are on a budget.

Students have the best tips on saving money for entertainment activities.

- Have healthier yet more filling meals such as potato or rice dishes before going out so that you don’t have to buy expensive takeaway food later.

- Prepare food for yourself before you go out.

- Use apps like Bigdish to find cheap food and discount offers.

3 Additional Benefits of Universal Credit to be claimed

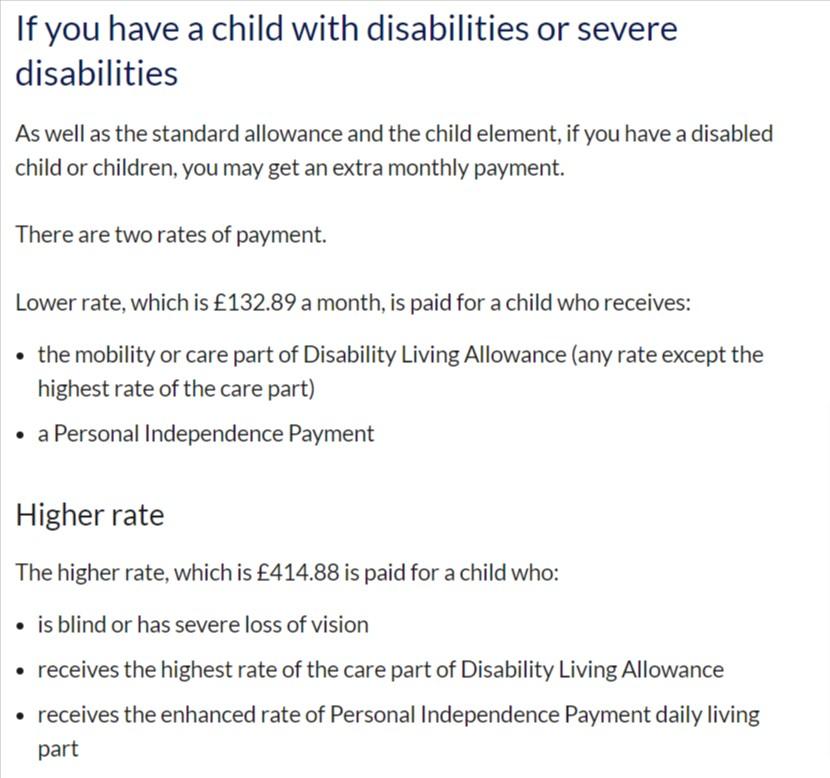

1. Disabled Child Allowance

You may get extra money if your dependent child is disabled. This amount is paid at a higher or lower rate based on your conditions.

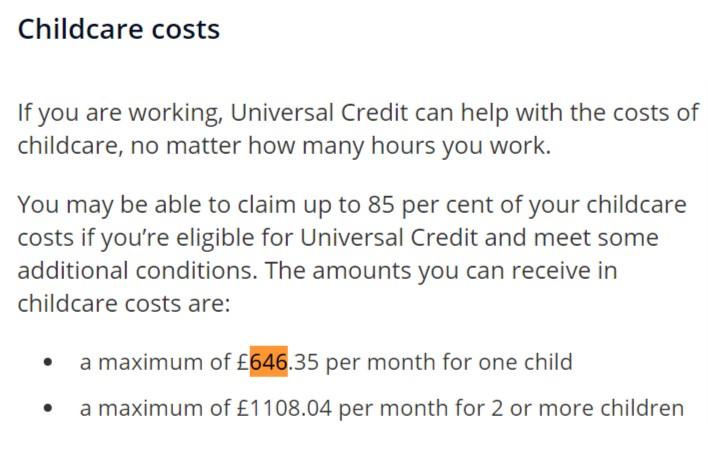

2. Childcare Cover

Regardless of the hours you work, you can apply for Universal Credit to help with the costs of childcare.

You can claim up to 85% of your childcare costs if you’re eligible for Universal Credit and meet some additional conditions. The amounts you can receive in childcare costs are:

- A maximum of £646.35 per month for one child

- A maximum of £1108.04 per month for 2 or more children

3. Extra Support

You can apply for Universal Credit and get non-monetary perks as well.

- Help with health costs, including prescriptions and dental treatment

- Additional help towards housing payments if your Universal Credit payment is not enough to pay your rent

- Free school meals

- Free early education for two-year-olds

- SureStart maternity grants

- Cold Weather Payments

- Support with travel costs to attend job interviews or start work

- Support with the provision of clothing to start work

- Support with upfront childcare costs until you receive your first wage

Read more about the additional benefits that you might qualify for.

You can use these calculators for information on more benefits:

Gather your household information about your savings, income including your partner’s (from pay slips, for example), existing benefits and pensions (including anyone living with you), outgoings (such as rent, mortgage, childcare payments), council tax bill to see how much Universal Credit, you can qualify for.

These tips should help all families that are likely to struggle during this recession and energy crisis and there are many things families can do to reduce their spending. If you have children that are students, you can check out these successful student finance blogs too for more inspiration.

Author Profile

- Shirley Owen is a blogger and writer who enjoys writing blogs on education, technology and general news. An avid reader, she follows all the latest news & developments to report on them through her articles.

Latest entries

careerApril 18, 2024Understanding Certificate III in Air Conditioning and Refrigeration: A Career Boost for Electricians

careerApril 18, 2024Understanding Certificate III in Air Conditioning and Refrigeration: A Career Boost for Electricians ed techApril 11, 2024Breaking Boundaries: Next-Gen Tools for E-Learning Course Development

ed techApril 11, 2024Breaking Boundaries: Next-Gen Tools for E-Learning Course Development careerMarch 13, 2024Degrees of Flavour: Exploring Culinary Education in Today’s Gastronomy Industry

careerMarch 13, 2024Degrees of Flavour: Exploring Culinary Education in Today’s Gastronomy Industry ed techFebruary 7, 2024What are EPS Files and How do you Manage them?

ed techFebruary 7, 2024What are EPS Files and How do you Manage them?

Source

Source Source

Source Source

Source Source

Source